With the continued increased costs of living in the UK and across the world, it is important to take control of your finances and understand how to prepare for the future. Here we have put together a few tips to help propel you to financial fitness.

Budget:

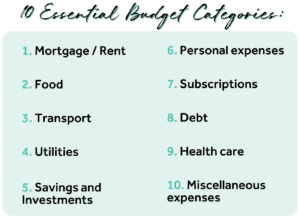

Putting together a budget gives you a better understanding of how you spend your money and gives you an insight into the areas you spend and where you could potentially save. Budgeting helps you manage your monthly expenses and prepare for future events.

Save, save, save:

It is recommended to start saving as soon as possible. If you have extra money left over at the end of the month, why not add it to a saving account? It’s also important to have different categories of savings.

Categories you may want to consider, are:

- Emergency saving – Protects you from financial shock

- Retirement saving – Allows you to be more comfortable later on in life

- Sinking funds – For known future expense obligations

- Long term savings – For long-term plans such as moving or a new car

Learn and educate yourself:

There is a famous quote “financial knowledge, is financial power” which means the more you learn, the easier it becomes to lead a financially fit life.

Athona knows how important financial fitness is for healthcare professionals, which is why we’re hosting a free webinar in partnership with financial experts Wesleyan, all about savings and investments. Giving healthcare professionals the opportunity to learn how to become financially fit and understand how to use your money wisely as a locum.

Sign up here to invest in your future.